What Was the Average Family Credit Card Debt in 2014

Average American Credit Card Debt in 2021: $5,525

Image source: Getty Images

According to the most recent inquiry, the boilerplate American credit card debt is $five,525. The average bill of fare balance has decreased past $968 from where it was earlier the COVID-19 pandemic, and the full U.Due south. credit card debt has likewise gone downward to $787 billion.

While those are the overall numbers, they vary significantly for unlike demographics. Nosotros've reviewed data from government agencies and credit bureaus to notice the average credit menu debt by land, age, income, and much more. Continue reading for the full results.

Key findings

- Average American credit card debt: $v,525

- Average credit utilization rate: 25.ii%

- State with the highest average credit card debt: Alaska ($7,089)

- Country with the everyman average credit card debt: Wisconsin ($four,587)

- Generation 10 has average credit card debt of $7,236, the most of whatever generation.

- Higher income corresponds to college average credit card balances, but consumers in the middle income brackets are the most likely to have credit card debt.

- Credit bill of fare interest rates have been ascent, and the average rate is now sixteen.2% on involvement-bearing accounts.

- Delinquency rates take been steadily decreasing, with the charge per unit of delinquencies of 90 days or more falling the near.

- The boilerplate credit menu balance has dropped by $968 since earlier the COVID-19 pandemic.

Average American credit card debt

The boilerplate American has a credit card residuum of $5,525.

Although that's a large corporeality, it has been dropping over the last ii years. The average balance was $6,629 in 2019 and $5,897 in 2020. That information comes from Experian and its yearly Country of Credit reports.

U.Southward. credit card debt as a whole reached an all-time loftier in 2019. Since peaking at $930 billion in the fourth quarter of that yr, it has fallen by over xv%, even though the total U.Southward. debt has kept going up.

| Year | Credit menu debt | Total debt | Credit card debt percent |

|---|---|---|---|

| 2003 | $693 billion | $7.38 trillion | 9.4% |

| 2004 | $697 billion | $viii.46 trillion | 8.two% |

| 2005 | $697 billion | $9.47 trillion | vii.4% |

| 2006 | $739 billion | $10.75 trillion | six.nine% |

| 2007 | $796 billion | $11.85 trillion | 6.7% |

| 2008 | $850 billion | $12.60 trillion | 6.7% |

| 2009 | $824 billion | $12.40 trillion | 6.six% |

| 2010 | $744 billion | $eleven.94 trillion | 6.2% |

| 2011 | $694 billion | $11.73 trillion | 5.9% |

| 2012 | $668 billion | $eleven.38 trillion | five.9% |

| 2013 | $669 billion | $11.fifteen trillion | 6.0% |

| 2014 | $669 billion | $11.63 trillion | 5.8% |

| 2015 | $703 billion | $11.85 trillion | 5.9% |

| 2016 | $729 billion | $12.29 trillion | 5.9% |

| 2017 | $784 billion | $12.84 trillion | 6.1% |

| 2018 | $829 billion | $13.29 trillion | 6.2% |

| 2019 | $868 billion | $xiii.86 trillion | half dozen.3% |

| 2020 | $817 billion | $14.27 trillion | 5.7% |

| 2021 | $787 billion | $14.96 trillion | 5.3% |

Data source: Federal Reserve Bank of New York (2021). Debt statistics are from the 2nd quarter of each year.

While it has been a very gradual change, credit card debt has become a smaller portion of Americans' full household debt.

What is the average American credit menu debt per household?

The average American credit carte du jour debt per household is about $6,125, based on the most recent U.Due south. credit card debt and household data.

Average credit card debt per household was calculated by dividing U.South. credit card debt in 2021 ($787 billion) by the about recent number of households taken in 2020 (128.45 one thousand thousand).

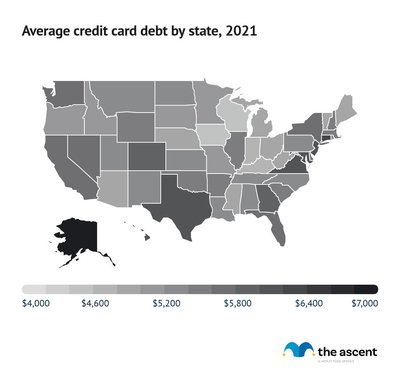

Average credit card debt by state

Credit card debt numbers vary quite a flake past state. Here's a full list of each state'south boilerplate credit card balance as of 2021.

| State | Average credit card debt |

|---|---|

| Alabama | $5,258 |

| Alaska | $seven,089 |

| Arkansas | $4,964 |

| Arizona | $5,414 |

| California | $5,635 |

| Colorado | $5,909 |

| Connecticut | $half dozen,237 |

| Delaware | $5,581 |

| Florida | $v,748 |

| Georgia | $5,822 |

| Hawaii | $6,197 |

| Idaho | $5,025 |

| Illinois | $5,552 |

| Indiana | $four,796 |

| Iowa | $4,587 |

| Kansas | $5,308 |

| Kentucky | $4,772 |

| Louisiana | $5,355 |

| Maine | $4,950 |

| Maryland | $vi,164 |

| Massachusetts | $5,448 |

| Michigan | $4,850 |

| Minnesota | $5,115 |

| Mississippi | $iv,819 |

| Missouri | $five,117 |

| Montana | $five,223 |

| Nebraska | $4,985 |

| Nevada | $v,651 |

| New Hampshire | $v,496 |

| New Bailiwick of jersey | $6,115 |

| New Mexico | $5,203 |

| New York | $5,754 |

| North Carolina | $five,361 |

| North Dakota | $five,223 |

| Ohio | $4,968 |

| Oklahoma | $5,571 |

| Oregon | $5,124 |

| Pennsylvania | $five,293 |

| Rhode Island | $5,324 |

| South Carolina | $five,523 |

| South Dakota | $5,007 |

| Tennessee | $five,234 |

| Texas | $vi,033 |

| Utah | $5,233 |

| Vermont | $4,963 |

| Virginia | $6,189 |

| Washington | $v,684 |

| Washington, D.C. | $six,367 |

| Due west Virginia | $4,831 |

| Wisconsin | $four,587 |

| Wyoming | $5,584 |

Information source: Experian (email communication, 2021).

States with the highest credit card debt

Alaska has had the highest credit card debt in contempo years, and in 2021, it was 28% more than than the national average.

- Alaska: $7,089

- Washington, D.C.: $vi,367

- Connecticut: $6,237

- Hawaii: $6,197

- Virginia: $vi,189

States with the lowest credit card debt

Wisconsin and Iowa both have 17% less credit menu debt than the national average, but it's Wisconsin that's the official winner. Earlier rounding off, its average credit card debt beat Iowa's by a razor-thin margin of $0.08.

- Wisconsin: $four,587

- Iowa: $4,587

- Kentucky: $four,772

- Indiana: $4,796

- Mississippi: $4,819

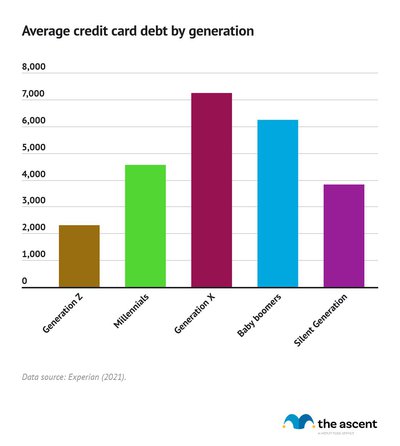

Boilerplate credit carte du jour debt by age

Generation X carries the highest average credit card balance at $7,236. That's over $1,000 more than than baby boomers, who came in 2d with an average balance of $6,230.

The lowest average credit card debt by historic period was Generation Z with $two,312. Since young adults accept lower incomes on average, they also have a lower boilerplate credit limit, which at least helps with avoiding credit carte debt.

| Generation | Average credit carte debt |

|---|---|

| Generation Z | $2,312 |

| Millennials | $4,569 |

| Generation Ten | $seven,236 |

| Baby Boomers | $6,230 |

| Silent Generation | $3,821 |

Data source: Experian (2021).

Average credit menu debt for higher students

College students have an average credit card debt of $1,183.

Considering students are often on a tight budget, their credit card balances are much lower than the average. Even though that's a expert sign, a lower-than-average balance can still be difficult to pay off when you have a limited income.

| Year | Average credit menu debt, college students |

|---|---|

| 2016 | $903 |

| 2019 | $1,183 |

Data source: Sallie Mae (2019).

Average credit card debt by income

Americans in higher income brackets carry higher credit card balances on average.

Yet, it'southward the heart class and the upper-middle course that'south more than likely to take credit card debt. Amid Americans in the 60th through 79th income percentiles, 56.viii% take credit card debt. Those in the 40th through 59th income percentile weren't far behind, as 55% have credit card debt.

It's the Americans in the highest (90th to 100th) and lowest (under 20th) income percentiles who are least likely to carry a rest. Less than a third of each group has credit bill of fare debt.

| Income percentile | Median annual income | Boilerplate credit carte du jour debt | Pct with credit card debt |

|---|---|---|---|

| Less than xx | $16,290 | $3,830 | xxx.five% |

| 20–39 | $35,630 | $4,650 | 45.half dozen% |

| forty–59 | $59,050 | $iv,910 | 55.0% |

| 60–79 | $95,700 | $6,990 | 56.8% |

| 80–89 | $151,700 | $nine,780 | 45.9% |

| 90–100 | $290,160 | $12,600 | 32.2% |

Data source: Federal Reserve Survey of Consumer Finances (2020).

Editor's annotation: Information from the Survey of Consumer Finances was nerveless in 2019, and is the most recent available from the Federal Reserve.

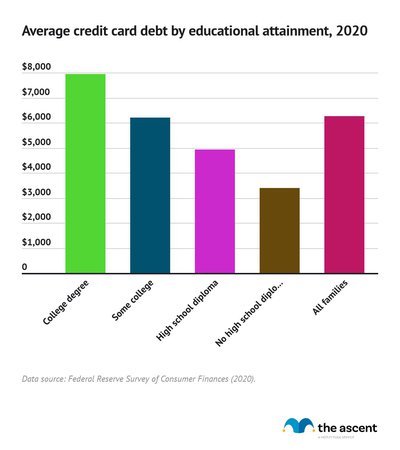

Average credit carte du jour debt by level of teaching

Average credit card debt is higher for Americans with higher levels of teaching.

College graduates have the highest average credit card debt at $vii,940. On the other hand, those with no high school diploma have $three,390 in average credit card debt.

The nigh reasonable explanation for this is each group's respective income. Median income increases at each level of education. Every bit an case, Americans with a bachelor's degree earn over twice as much as Americans with no high school diploma. College income, as we saw earlier, corresponds to higher credit carte debt.

| Educational attainment | Average credit card debt |

|---|---|

| College degree | $7,940 |

| Some college | $6,210 |

| Loftier school diploma | $4,940 |

| No loftier school diploma | $three,390 |

| All families | $6,270 |

Data source: Federal Reserve Survey of Consumer Finances (2020).

Average credit carte debt by race

White Americans take average credit carte du jour debt of $half-dozen,940, the most of whatever racial group.

Black Americans accept the lowest average credit card debt at $3,940, and Hispanic Americans are correct in between those two other groups with $5,510 in average credit card debt.

| Race/ethnicity | Average credit card debt |

|---|---|

| White, non-Hispanic | $6,940 |

| Blackness, non-Hispanic | $3,940 |

| Hispanic | $5,510 |

| Other | $6,320 |

| All families | $6,270 |

Data source: Federal Reserve Survey of Consumer Finances (2020).

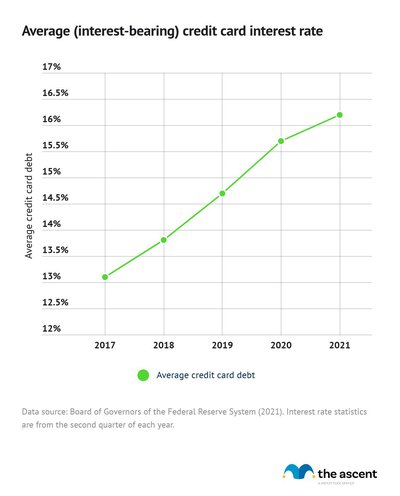

Average credit bill of fare interest rates

The boilerplate credit carte du jour APR on interest-bearing accounts is 16.two%.

Involvement-begetting accounts include all credit cards that charge involvement. It excludes credit cards that aren't charging interest at that fourth dimension, so 0% intro APR credit cards don't count until the introductory menstruum ends.

| Twelvemonth | Average (interest-bearing) credit bill of fare involvement rate |

|---|---|

| 2017 | 13.1% |

| 2018 | thirteen.viii% |

| 2019 | 14.7% |

| 2020 | 15.seven% |

| 2021 | sixteen.2% |

Data source: Board of Governors of the Federal Reserve Arrangement (2021). Interest rate statistics are from the second quarter of each yr.

Credit card involvement rates have been steadily increasing at a rate of nearly 0.viii% per year since 2017. They slowed down a bit this last year, when they grew by 0.five%.

Interest income makes up a significant chunk of credit carte company earnings. Information technology was 43% of the $176 billion credit card companies fabricated in 2020.

Credit card delinquency rates

A credit carte account is considered delinquent when information technology's at least 30 days past due. Although that already does meaning damage to the cardholder'south credit score and carries financial penalties, the consequences go worse equally the bill of fare passes lx and xc days past due.

Credit card delinquency rates have fallen over the past 2 years. Delinquencies of 90 days or more accept seen the best results, as they're downwards 63%.

| Days past due | 2019 | 2020 | 2021 |

|---|---|---|---|

| xxx–59 | 3.9% | 2.4% | ii.3% |

| threescore–89 | one.9% | 1.3% | ane.0% |

| 90 or more | half-dozen.8% | 3.8% | 2.5% |

Data source: Experian (2020).

Credit card malversation rates by generation

Millennials and Generation X take the highest credit card delinquency rates by a big margin in 2021. Members of the Silent Generation are the to the lowest degree probable to be runaway on their credit cards.

| Generation | thirty–59 days | 60–89 days | 90 or more days |

|---|---|---|---|

| Generation Z | 2.12% | 0.95% | 1.73% |

| Millennials | 3.07% | ane.32% | iii.fifteen% |

| Generation X | 3.02% | 1.25% | 3.42% |

| Baby Boomers | 1.80% | 0.77% | 2.05% |

| Silent Generation | 1.07% | 0.51% | 1.33% |

Data source: Experian (2021).

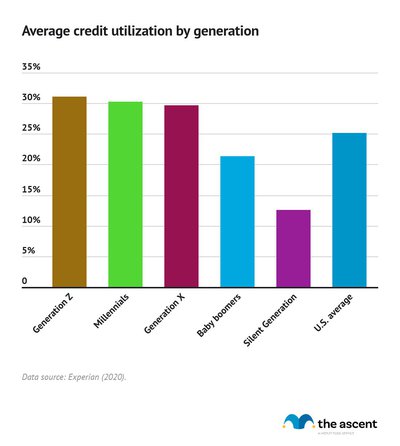

Average credit utilization rate by age

The average credit utilization rate is 25.ii%.

This metric, as well known as a credit utilization ratio, is your credit card balances divided by your credit limits. If y'all have ane credit card with a $1,000 balance and a $10,000 credit limit, then your credit utilization would be 10%.

Lower credit utilization is improve for your credit score, and the conventional wisdom is that you should continue it below 30%. Most generations manage that. While Gen Z, millennials, and Gen 10 all accept averages of around 30%, the average credit utilization drops quite a bit for infant boomers and the Silent Generation.

| Generation | Average credit utilization |

|---|---|

| Generation Z | 31.i% |

| Millennials | xxx.2% |

| Generation X | 29.7% |

| Babe boomers | 21.4% |

| Silent Generation | 12.6% |

| U.Southward. Average | 25.2% |

Data source: Experian (2020).

How the COVID-19 pandemic affected credit card debt

Since the early stages of the COVID-nineteen pandemic, credit card balances have declined sharply. The average credit bill of fare rest was almost thirteen% lower in March 2021 than it was the twelvemonth earlier, according to a report by the Consumer Financial Protection Bureau.

The boilerplate credit card balance of $5,525 reported past Experian is a decrease of $968 from where information technology was prior to COVID-19.

Delinquency rates take too declined. The assistance programs that credit carte du jour companies offered during the pandemic may accept played a part in helping cardholders avert delinquencies. In April 2020, two% of open credit carte accounts started reporting assistance.

Nearly cardholders didn't need assistance programs for long. About 0.8% of credit bill of fare accounts transitioned out of assistance in May 2020, and another 1.1% of accounts transitioned out in June 2020.

How to go out of credit card debt

As we've seen from these credit menu debt statistics, owing money to credit bill of fare companies is a very mutual issue. Many Americans have expensive credit bill of fare balances that are costing them involvement every calendar month.

If you're in this situation, here are some methods to consider that can help you go out of credit menu debt:

- Go on your credit card charges to a minimum. Either don't use credit or only employ information technology for necessary expenses so you don't add together to your debt.

- Cut spending where you can. Look at your contempo spending, see if at that place's anywhere yous can cutting back, and make a budget that y'all tin can employ going forrad. There are several budgeting apps that tin help here. Put as much disposable income as possible towards your credit carte payments.

- Look into balance transfer credit cards and debt consolidation loans. These are both fiscal tools that you lot can utilize to pay off debt. Residual transfer credit cards offer a 0% intro April on credit card debt you transfer over. Debt consolidation loans typically have lower interest rates than most credit cards. They also have a fixed payment amount and length, which can provide the structure needed to eliminate credit bill of fare debt.

Sources

- Board of Governors of the Federal Reserve System (2021). "Commercial Bank Interest Rate on Credit Carte Plans, Accounts Assessed Interest-Federal Funds Effective Rate."

- Consumer Financial Protection Bureau (2021). "Credit carte du jour use is all the same declining compared to pre-pandemic levels."

- Consumer Financial Protection Bureau (2020). "The Early Effects of the COVID-nineteen Pandemic on Consumer Credit."

- Experian (2020). "Credit Bill of fare Debt in 2020: Balances Driblet for the Offset Fourth dimension in Eight Years."

- Experian (2020). "State of Credit 2020."

- Experian (2021). "Country of Credit 2021."

- Federal Reserve Bank of New York (2021). "Quarterly Report on Household Debt and Credit."

- Federal Reserve Survey of Consumer Finances (2021). "2019 Survey of Consumer Finances (SCF)."

- Sallie Mae (2019). "Majoring in Money 2019."

Source: https://www.fool.com/the-ascent/research/credit-card-debt-statistics/

0 Response to "What Was the Average Family Credit Card Debt in 2014"

إرسال تعليق