how to determine what by ratios what company is better in liquidity and efficincy

The raw numbers reported on a company's financial statements are informative, but to unlock insights, spot trends, and compare against competitors, you lot have to wait at the relationship between those numbers. That'southward where financial ratios come in. There are four types of financial ratios, each of which tells a different part of a company'south financial story.

The Basics

- Ratios tell a more complete story about a company's fiscal health than numbers alone.

- Financial ratios are a comparing between 2 numbers that tin reveal how a visitor operates, aspects of its financial health, and how it stacks up confronting competitors.

- At that place are four types of financial ratios: profitability, leverage, liquidity, and efficiency ratios.

What are financial ratios?

A financial ratio is simply the relationship between two numbers taken from a company's fiscal statements. You generate a ratio by dividing one number past the other. Ratios will sometimes use numbers from the same statement—the income statement, for example—or from different statements.

There are four types of financial ratios:

- Profitability ratios tell you lot how well a company is producing profits

- Leverage ratios tell yous how extensively the company uses debt

- Liquidity ratios tell you if the company has plenty cash to embrace its bills

- Efficiency ratios tell you how efficiently the company uses its assets and capital.

Different ratios tell you lot different things, which means that a high ratio isn't necessarily proficient or bad. For some measures, a high ratio is desirable; for others, a low ratio is desirable.

Profitability ratios

These ratios use numbers on the income statement to give you a moving-picture show of how well a company is doing at taking things like acquirement, assets, operating costs, and equity and turning them into profit.

Gross profit margin ratio

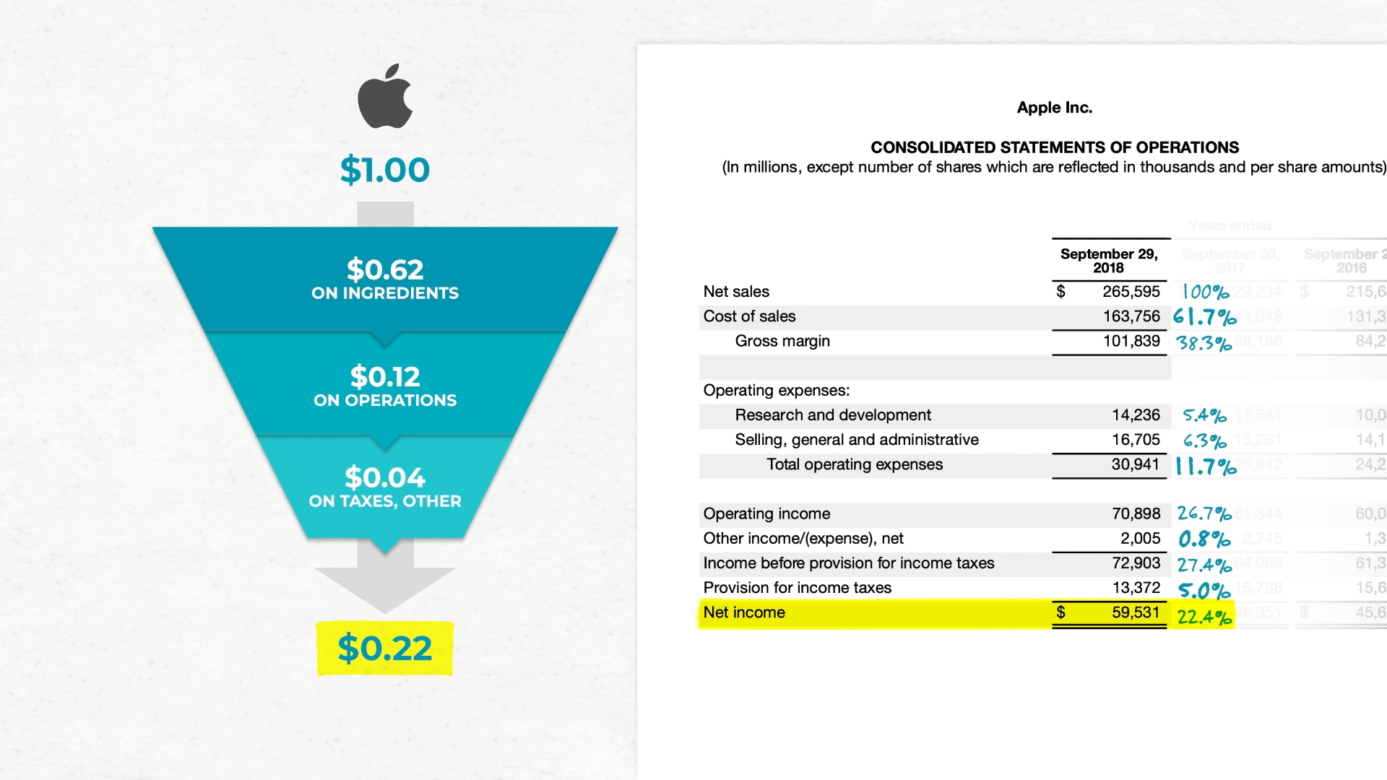

Gross profit margin is the ratio of gross margin to net sales, expressed as a percentage. This ratio answers the question: For every dollar of sales, how much do we make after paying for the ingredients and costs direct associated with making the product?

Gross turn a profit margin percentage = (Gross margin / Internet sales) ten 100%

In this equation:

- Gross profit is the divergence between net sales and the toll of net sales.

- Net sales is the company'south total revenue from sales minus returns and discounts.

The gross profit margin ratio is a cardinal indicator for how much profit a visitor makes from what it sells, given the price of making their production. Generally, the higher the gross profit margin percentage, the amend a company is at turning sales into profits.

Operating profit margin ratio

Operating profit margin is the ratio of operating income to revenue, expressed as a percentage. This ratio answers the question: For every dollar of sales, how much money practice nosotros have left over after paying for materials and overhead?

Operating profit margin percentage = (Operating income / Net sales) ten 100%

In this equation:

- Operating income is a company'due south full revenue minus COGS (cost of goods sold) and operating expenses.

- Net sales is the company's total revenue from sales minus returns and discounts.

The operating margin ratio is a key indicator for how well a company can earn profits from its core product or service offering. By and large, the higher the ratio, the better a company is at turning sales into profits.

While this ratio is similar to the gross turn a profit margin ratio in that both measure how profitable a company is, gross profit margin subtracts costs associated with product and distribution, whereas operating profit margin subtracts additional costs: COGS and operating expenses. Non-operating expenses like taxes and involvement are notwithstanding non accounted for—but they volition exist in the side by side ratio.

Net profit margin ratio

Internet profit margin is the ratio of cyberspace income to net sales, expressed as a percentage. This percentage answers the question: For every dollar of sales, how much money do we have left over after paying for everything, including interest and taxes?

Net turn a profit margin percentage = (Cyberspace income / Net sales) x 100%

In this equation:

- Net income is a visitor'southward total profits after subtracting the cost of all of its expenses from acquirement generated over a reported menstruation of time.

- Net sales is the visitor's full revenue from sales minus returns and discounts.

The net profit margin per centum is a key indicator of how much money the company is making when all is said and done. A higher percentage means a healthier business and happier shareholders, since this is the coin that can be reinvested in the business or paid to shareholders in the class of dividends.

Return on assets per centum

Return on assets is the ratio of net income to assets, expressed as a percentage. This ratio answers the question: For every dollar tied up in your business, how much comes back as profit?

Return on assets percentage = (Net income / Assets) x 100%

In this equation:

- Net income is a visitor's total profits after subtracting the cost of all of its expenses from revenue generated over a reported period of fourth dimension.

- Assets are everything you've got invested in your business, including cash, equipment, factories, offices, or other real estate.

The return on avails ratio is a key indicator of whether a company is using its avails well; in other words, how profitable a visitor is, according to its avails. A good return – assets percent is considered to be anything over five%; a percent beneath that could mean the company isn't profitable plenty. Anything over 20% is considered outstanding. But keep in heed that an extremely high percentage may point another kind of consequence—for example, perhaps the business isn't investing enough in new equipment.

What's considered a good or neat percentage can likewise vary beyond industries, which makes sense if yous recollect almost it: A financial services company volition accept very dissimilar assets from a car maker.

Return on disinterestedness percentage

Return on disinterestedness is the ratio of net income to shareholder's equity, expressed as a percentage. This percentage answers the question: For every dollar that shareholders invest in the company, how much is coming dorsum as profit?

Return on equity per centum = (Net income / Shareholders' equity) x 100%

In this equation:

- Net income is a visitor's full profits after subtracting the toll of all of its expenses from revenue generated over a reported flow of fourth dimension.

- Shareholders' equity is full assets minus total liabilities.

While a high return on disinterestedness will make shareholders happy, information technology tin can as well indicate that the company is taking out loans to finance their concern, and thus may have an unreasonable corporeality of debt.

Leverage ratios

Leverage ratios indicate how companies use debt. While debt tin help a company get a higher return on its cash investment, too much debt increases the probability of defalcation.

Debt to equity ratio

Often referred to as" D/E ratio," the debt to equity ratio measures a company'due south liabilities against its shareholder disinterestedness. This ratio answers the question: For every dollar of equity, how much debt is in that location?"

D/Due east ratio = Full liabilities / Shareholders' equity

In this equation:

- Full liabilities are all of the debts or obligations that detract from a visitor'south value.

- Shareholders' equity is total avails minus total liabilities.

The D/E ratio is used to analyze a company's financial leverage, or how a company is using its debt to finance its operations and avails. Put another way, it compares a visitor's liabilities (all the debts it still owes) to its equity (assets minus liabilities), producing a number that tells you whether the visitor's debt is helping it grow.

Using debt tin can be a good thing, every bit it can increase the return shareholders get on the money they invested in the business concern. For this reason, you wouldn't wait the D/E ratio to be 0, or even less than 1. But a number that is high can point increased chance of bankruptcy, if the company is taking on more than debt than it could always pay back.

Interest coverage ratio

Interest coverage is the ratio of operating profit to annual interest charges. Operating profit is used in this ratio instead of internet income considering operating profit is calculated excluding involvement payments.

Involvement coverage ratio = Operating profit / Annual interest charges

This ratio should tell y'all how much money a company has left over to pay interest. It'southward often used by banks to determine whether a loan should be approved, considering it indicates if a company probable has plenty money to pay dorsum its debt, plus interest.

Liquidity ratios

Liquidity is all about common cold, hard cash—though information technology also extends to the liquid avails a company can convert to cash quickly. Greenbacks is life in business, so these ratios tell you if a company will have enough cash in the nigh term to see its obligations.

Current ratio

The current ratio is a ratio of the company's electric current assets to electric current liabilities. This ratio measures a company'due south ability to produce greenbacks to pay for its short-term financial obligations, too known equally liquidity.

Electric current ratio = Current assets / Electric current liabilities

A ratio above 1 means the value of a company's current assets is more than its current liabilities. A number less than 1, on the other hand, means that liabilities outweigh assets. For the company, this could point towards financial issues with creditors, growth, or production, and could ultimately lead to bankruptcy.

Quick ratio

A quick ratio differs from a current ratio in one attribute: it subtracts inventory from current assets. Inventory is your actual product, and therefore the only attribute of your current assets that can't exist converted into cash quickly (you'd need to sell all of it off to turn into cash).

Electric current ratio = Electric current assets – Inventory / Current liabilities

Efficiency ratios

Efficiency ratios measure how efficiently assets and liabilities are being managed.

Asset turnover ratio

Nugget turnover is a ratio of net sales to average total assets. It answers the question: how well avails are beingness used to create sales?

Avails turnover ratio = Net sales / Average total assets

This is a primal indicator of how well a company's investment in assets (a new factory for example) is helping it generate sales.

Inventory turnover ratio

The inventory turnover ratio illustrates how many times a company has sold out inventory over a given time flow. It'south calculated using financial information found on both a company's income statement and balance sheet. Toll of Goods Sold is found on the income statement, while the inventory values at the beginning and ending of the month (or any time period you lot wish to calculate) is indicated on the balance sheet.

Inventory turnover ratio = COGS / Average inventory

In this equation:

- COGS or the cost of goods sold is the direct price of making and distributing a product.

- Average inventory is the value of inventory at the starting time and end of the given time catamenia, added together and divided by 2.

A high inventory turnover ratio is typically better than a low ane, though there are deviations from this dominion. A high ratio could indicate stellar sales, but it could also mean that demand for a company's product or service exceeds the supply.

Days in inventory ratio

Days in inventory is a ratio of boilerplate inventory over a period of fourth dimension divided past cost of sales per twenty-four hour period. This ratio answers the question: How long does inventory stay in the organisation?

Days in inventory ratio = Average inventory over time period / toll of sales per twenty-four hours

This ratio is a key indicator of how you are managing your inventory. Manufacture norms vary, merely generally you should want this ratio to exist depression. That ways your inventory is generating cash chop-chop. Just if information technology's too low, information technology could mean that you're not producing plenty inventory, or you lot're experiencing delays that could make for a bad customer experience.

Days sales outstanding ratio

Days sales outstanding is a ratio of average accounts receivable to net sales per day, divided by days in a yr. This ratio answers the question: How many days does information technology take, on average, for customers to pay their bills.

Days sales outstanding ratio = (Average accounts receivable / Net sales) / 365

While getting customers to pay outstanding bills may seem like information technology's outside of the business'southward command, this ratio can withal tell you something about how the business organization operates. If the number is too high, it means that the company needs to improve its ability to collect on invoices.

Pareto Labs offers engaging online courses in business fundamentals, like h ow to read fiscal statements . Built to help you elevate your game at work, our courses distill complex business topics into digestible lessons. No business background required. Sign up for a course today and go the start iii lessons for gratis.

Source: https://www.paretolabs.com/financial-ratios-how-to-calculate-and-analyze/

0 Response to "how to determine what by ratios what company is better in liquidity and efficincy"

إرسال تعليق